This past week the Dow Jones continued its descent erasing almost all of the gains the stock market has made since Trump took office in 2016. In last week’s newsletter I had hypothesized that the single day 1000 point drop in the Dow was just the first of many. On Monday, March 16th the Dow had dropped an additional 3000 points or 13% which was the biggest one-day plunge the stock market has ever seen. It was the highest percentage decline since the infamous “Black Monday” crash of 1987, with the Dow closing 12.9 percent down.

The stock market’s reaction this past week was a clear indication that the Fed’s proposal didn’t fully appreciate the severity of this economic crisis. As I write this stock market futures are already down 5% as there is still no deal on an economic rescue package. It’s imperative that they get money into the hands of the people as fast as possible.

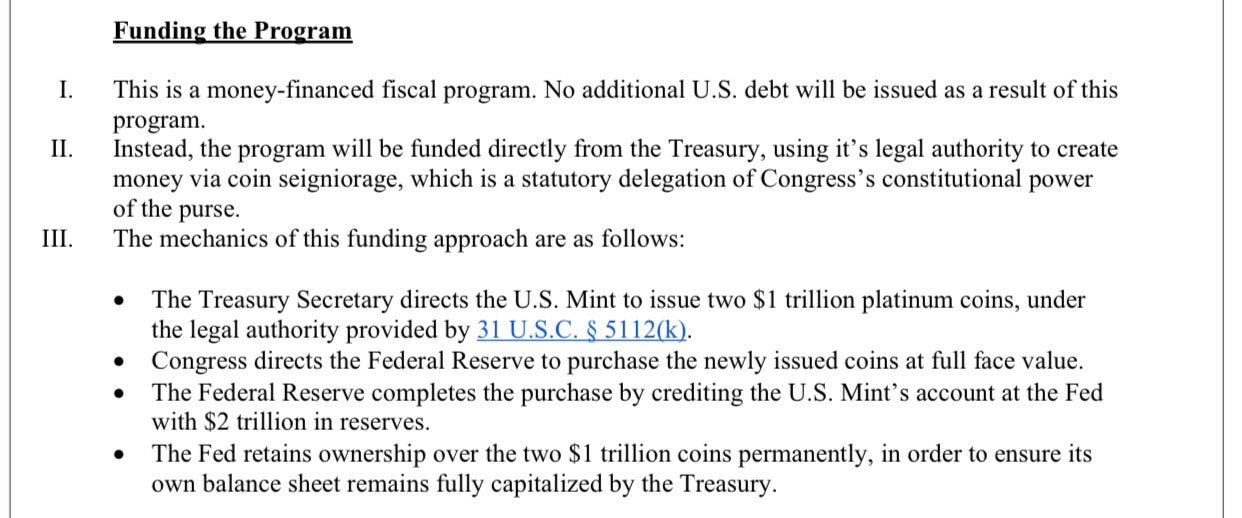

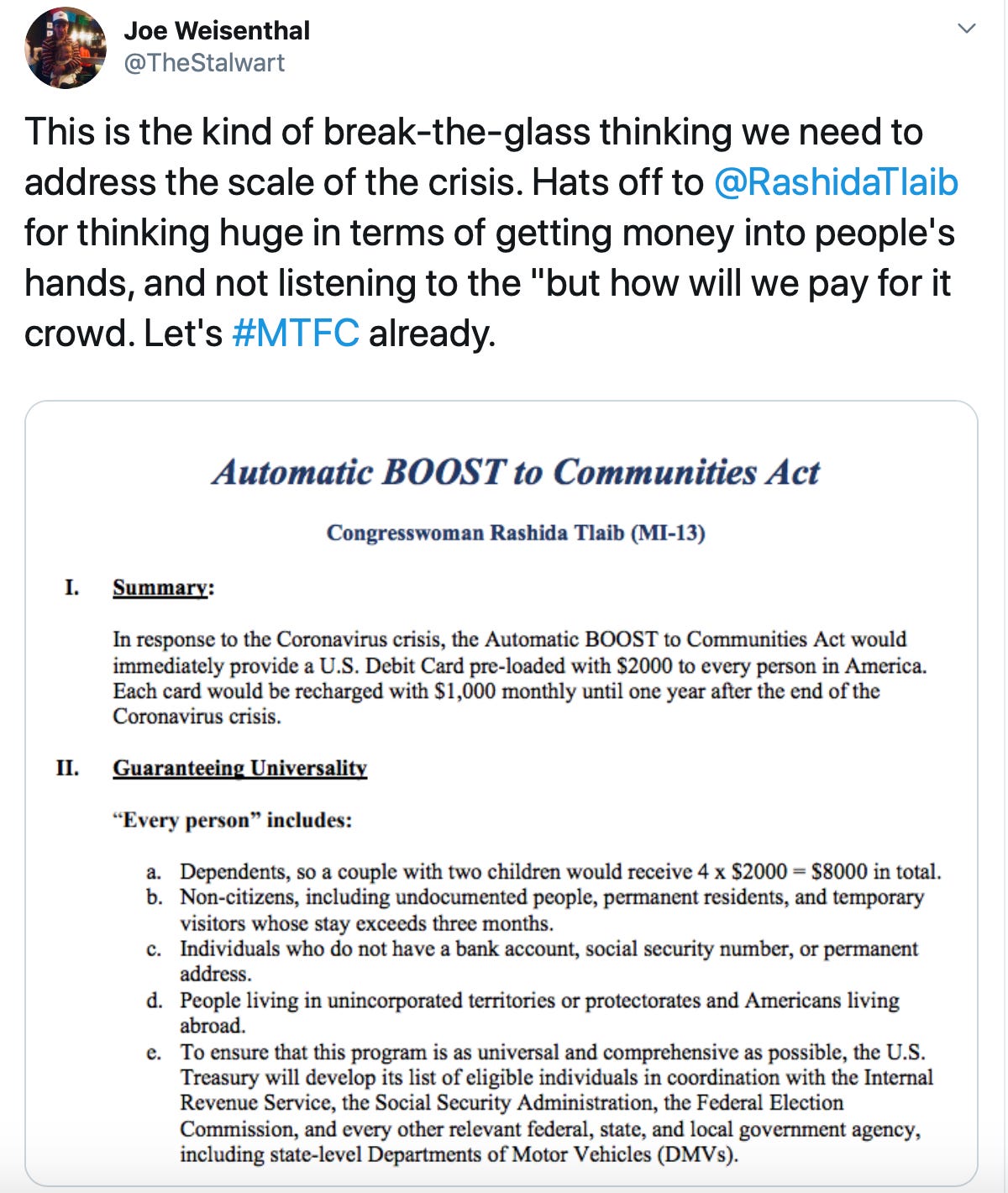

In and effort to do just that, Congresswoman Rashida Tlaib proposed to “mint the coin”.

The crisis we currently face is calling for unprecedented solutions. Congresswoman Tlaib’s proposal to mint two $1 trillion coins would have been labeled as absolutely insane 3 months ago but, now in the face of crisis, seems all too feasible. It’s a shot in the dark whether the bill has any chance on the floor but it’s this type of out of the box thinking that its going to get cash into the people’s hands as fast as possible.

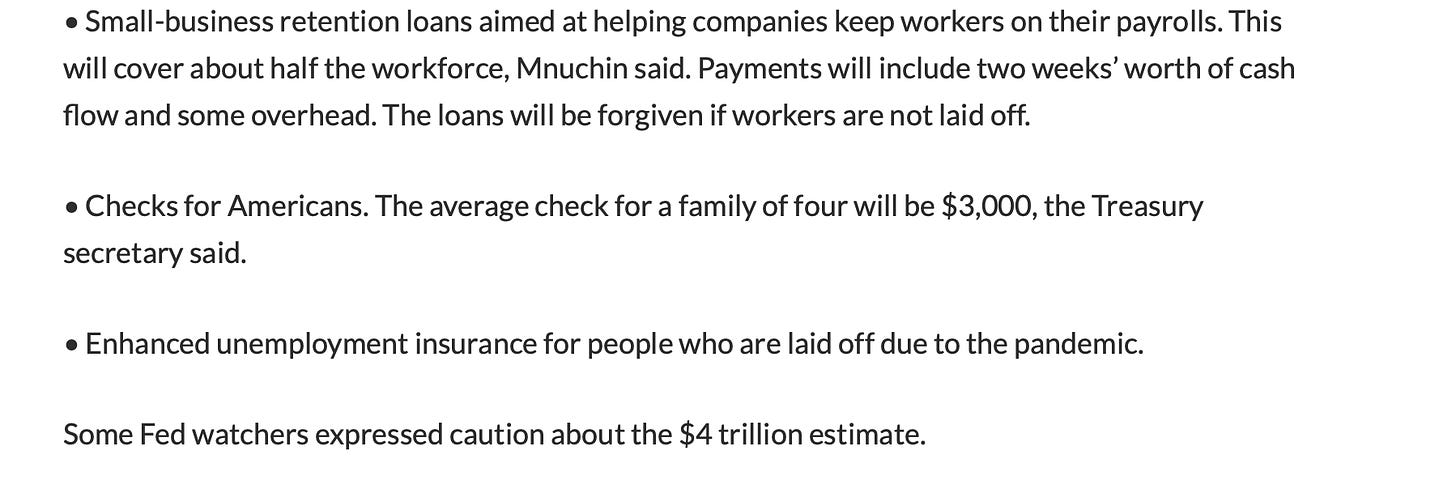

However, Treasury Secretary Steven Mnuchin has a plan of his own. The coronavirus economic relief bill being finalized by the U.S. Congress will include a one-time $3,000 payment for families of four and allow the Federal Reserve to leverage up to $4 trillion of liquidity to support the nation's economy, Mnuchin said on Fox News Sunday.

Mnuchin also said that the liquidity measures would allow the U.S. central bank to help a broad base of businesses get through the next 90 to 120 days and that if the shutdown lasts longer then expected that congress will pass another rescue package.

The Fed has concluded that the coronavirus is going to have a lasting impact on our economy. Federal Reserve Bank of St. Louis President James Bullard predicted the U.S. unemployment rate may hit 30% in the second quarter because of shutdowns to combat the coronavirus, with an unprecedented 50% drop in gross domestic product. JPMorgan Chase & Co. expects gross domestic product to shrink at an annualized rate of 14% in the April-June period while Bank of America Corp. and Oxford Economics both see a 12% drop. Goldman Sachs Group Inc. sees a 24% plunge.

To add insult to injury Goldman Sachs was forced to provide $1 billion to its own money-market fund after investors pulled $8.1 billion dollars from two Goldman money-market funds during a four-day period. This massive withdrawal shows that investors would rather hold cash then put it to work which is very telling of a recession.

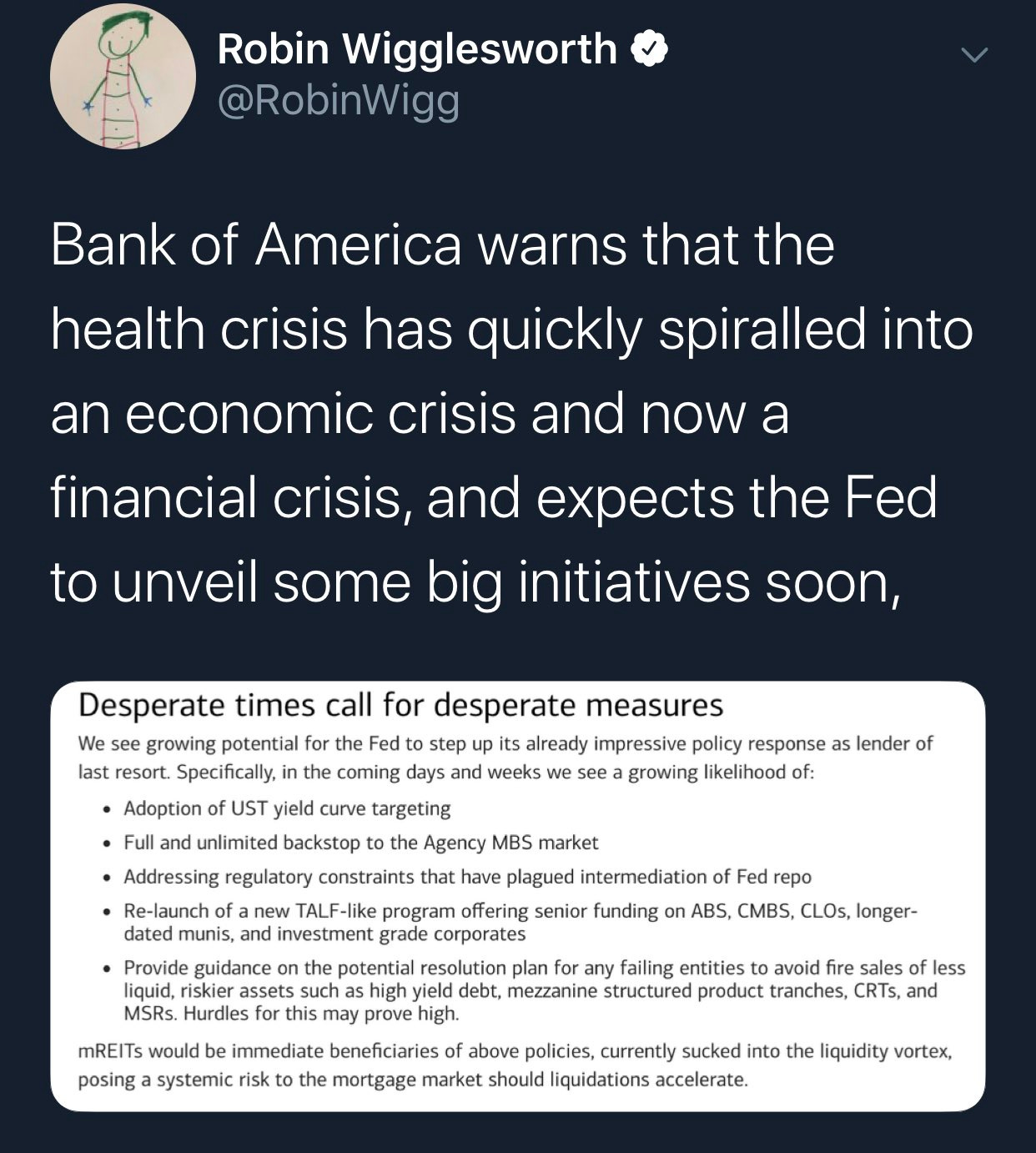

Bank of America understands the implications of an economic shutdown and they are expecting the Fed to take more initiative.

Everyday that a business has to close its doors is a day of lost revenue for the business and a day of lost income for its employees. The largest threat that the US economy faces is the lack of coordination of the current economic shutdown. States that have been hit the hardest like California and New York are currently under strict curfew while a majority of other states still conduct business as usual.

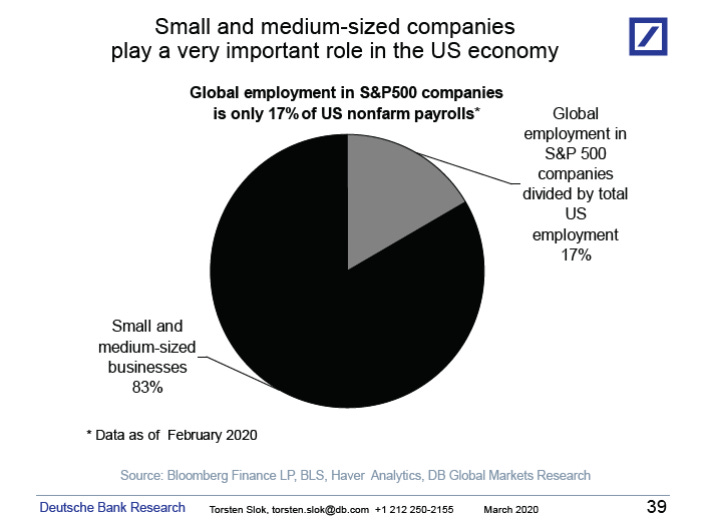

If we do not coordinate a national shutdown of the economy the coronavirus will continue to spread and it will take a lot longer for things to return to normal. The longer businesses have to keep their doors shut, the more likely it is that they won’t be able to reopen once this is all said and done. If businesses don’t reopen then their employees will be out of work. Many small businesses already face this sad reality and most Americans work for small businesses.

Conclusion: If we do not coordinate a national shutdown as soon as possible while also getting cash into the American people’s hands then I believe this recession will last much longer than originally expected.