An Asset in Turmoil, a Generational Opportunity or Both?

MarketAlpha Weekly

Oil is one of the most important commodities in our global economy. We need oil to power our planes, trains, automobiles, as well as our heating and electricity. We also use oil for a plethora of other things like making plastics and paints. Our current lifestyles would not exist without oil.

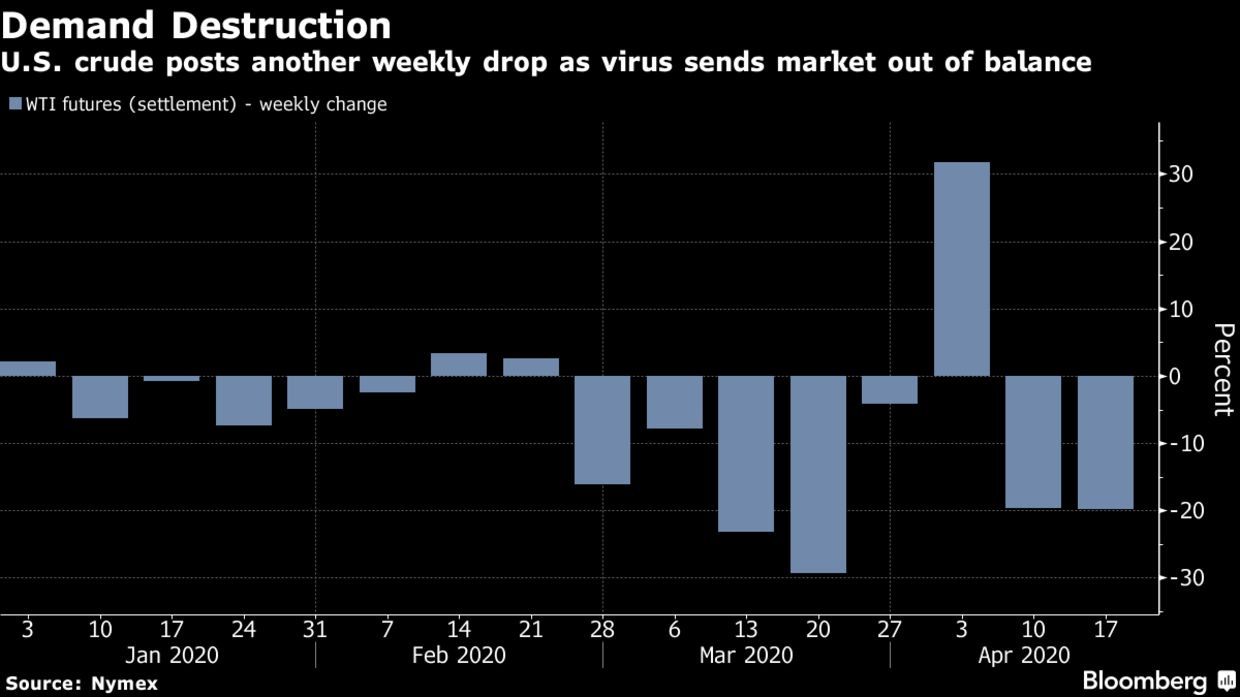

However, when our lifestyles are halted so is oil consumption. Oil has been in a free fall since the news of an economic shutdown to prevent coronavirus broke mainstream news. Investors understand that in an economic shutdown there is no demand for oil, as there is no demand for transportation, products, or literally anything besides necessities like food and water.

To make matters worse, Saudi Arabia and Russia have been in a price war catching U.S. shale producers in the crossfire. Oil has taken a significant beating between the lack of demand for oil and the Saudi-Russia price war. Oil started the year around $60. As I write this, Oil has declined to $15. The price of oil has effectively been quartered just within the past few months.

The United States, Saudi Arabia, and Russia are the largest producers of oil in the world making up about 50% of all oil production across the globe. This means they also have the most to lose as oil prices descend to levels not seen since the 1990s. According to CCN, the breakeven price for the U.S. shale industry lies in the $48 to $54 per barrel range. This means almost every U.S. shale producer is currently running on a deficit which is not sustainable.

In an effort to remedy this, the free market will take action. The larger oil companies like Exxon Mobile will buy up bankrupted oil companies at a major discount bringing their overall breakeven costs down. However, even if this brought down Exxon’s breakeven cost to $30, the price of oil still needs to be above $30 for these companies to turn a profit. The other problem is that Exxon won’t be the only company looking for a stake in U.S. shale producers. I personally believe foreign countries, including Saudi Arabia, will be quick to buy up U.S. oil companies while they are on sale.

But why not just let these oil companies fail? They are a thing of the past anyways, right? Well, not exactly.

The first major problem is that oil companies make up about 10% of our entire economy in the United States. Mostly high paying jobs with great benefits. States like Texas, Ohio, and Pennsylvania rely on their oil based economies.

The second major problem is that we still heavily rely on oil as our main energy source. There isn’t a doubt in my mind that our global economy will run solely on renewable energies at some point in the future. However, I don’t think this will happen in my lifetime (but anything is possible!).

Renewable energies are incredibly expensive compared to oil. The other problem is that most renewable energies are still less efficient and less effective than oil. But as mainstream opinion shifts, companies have been incentivized to switch to renewable energies. This was not the case over a decade ago. Why would companies choose a more expensive yet less efficient product when they could just have the cheaper and more efficient option? While the government subsidies are nice, branding your company as environmentally friendly has shown to have a dramatically positive effect on public opinion which translates into loyal customers who spend more. As time progresses renewable energy will become far less expensive and far more efficient but I still think oil will continue to be the dominant energy source for at least the next few decades.

I am long term bullish on renewable energy but oil is still far more attractive for the reasons listed above.

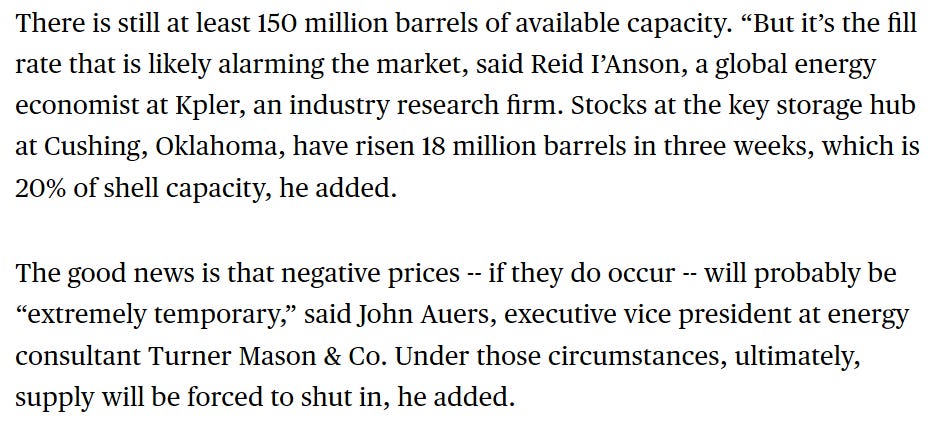

Since the oil price war began demand for oil has been shrinking while the supply of oil reaches unprecedented levels. This has created the possibility for negative oil prices. But how can oil prices be negative? Doesn’t this mean the seller of oil would pay the buyer? Yes, that is exactly what that means. It costs money to store oil and as the supply glut grows its becoming harder and harder to find places to store it.

“Concern continues to mount that storage facilities in the U.S. will run out of capacity,” ANZ Research said in a note. “Stockpiles at Cushing, the pricing point for WTI, are up nearly 50% since the start of March.” - Bloomberg

I want to make it clear that for the first time ever there is a fear that oil prices will go negative. Storage space is so scarce in Texas that they anticipate oil prices will go negative for an “extremely temporary” amount of time.

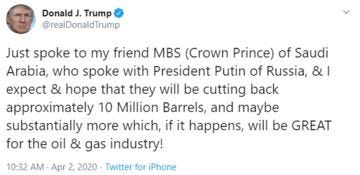

On April 12th, the energy superpowers of the world agreed to limit production to prop up the price of oil. They have agreed to limit the amount of oil they produce in the future. However, they continue to flood the market with oil until the agreement officially begins. This means we won’t see a meaningful decrease in oil production for weeks if not months.

The Organisation of the Petroleum Exporting Countries (opec) and its allies, including Russia, said they would slash production by 9.7m barrels a day from May to the end of June, a record, and restrain output for two years. - The Economist

The combination of the economic shutdown and the Saudi price war has created a generational opportunity to purchase oil at prices we may not see again for decades. If U.S. oil companies are expected to survive, the price of oil needs to go up. The US government has all the incentive they need to drive oil prices higher, so I believe they will. Trump has made several comments about protecting the industry and driving prices higher. He took to Twitter on April 2nd to reassure oil producers and investors that a deal was imminent. On April 12th the deal was announced. Trump has a lot to lose if U.S. shale producers go under, like the upcoming election. For example, Trump could lose Pennsylvania (a huge swing state) if he let declining oil prices continue to grip the industry.

I don’t know exactly what price oil will bottom at but we can use technical analysis to venture a guess. It seems support is somewhere between $10-$14. As we approach these levels it’s important to remember we haven’t seen these prices in two decades.

Conclusion: Renewable energies will make oil obsolete. However, its unrealistic to believe that will happen any time soon. Buying oil under $14 is a generational opportunity. I also think Exxon Mobile is a bargain under $45.

Disclaimer: All content is provided as information used for research purposes only and should not be taken as investment or trading advice. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein, are committed at your own risk, financial or otherwise. I am not a financial advisor and I am certainly not your financial advisor. If you think adding oil to your portfolio is right for you then I suggest contacting your financial advisor.