Bitcoin: The World is Watching

MarketAlpha Weekly

Over the weekend Warren Buffet held the Berkshire Hathaway shareholder meeting in which he praises Jerome Powell for his swift action in shoring up the credit markets.

He said:

We came very close to having a total freeze of credit to the largest companies in the world who were depending on it.

Every one of those people that issued bonds in late March and April ought to send a thank you letter to the Fed because it would not have happened if they hadn't operated with really unprecedented speed and determination.

And he’s right — without the Federal Reserve’s response, companies would have gone bankrupt and millions of more American’s paychecks would’ve evaporated.

Buffet then acknowledges that the Fed’s actions don’t come without unintended repercussions.

We don't know what the consequences are of the Fed's balance sheet expansion. But we do know the consequences of doing nothing. And that would've been the tendency of the Fed in many years past, not doing nothing, but doing something inadequate.

Warren Buffet said the following at the shareholder meeting:

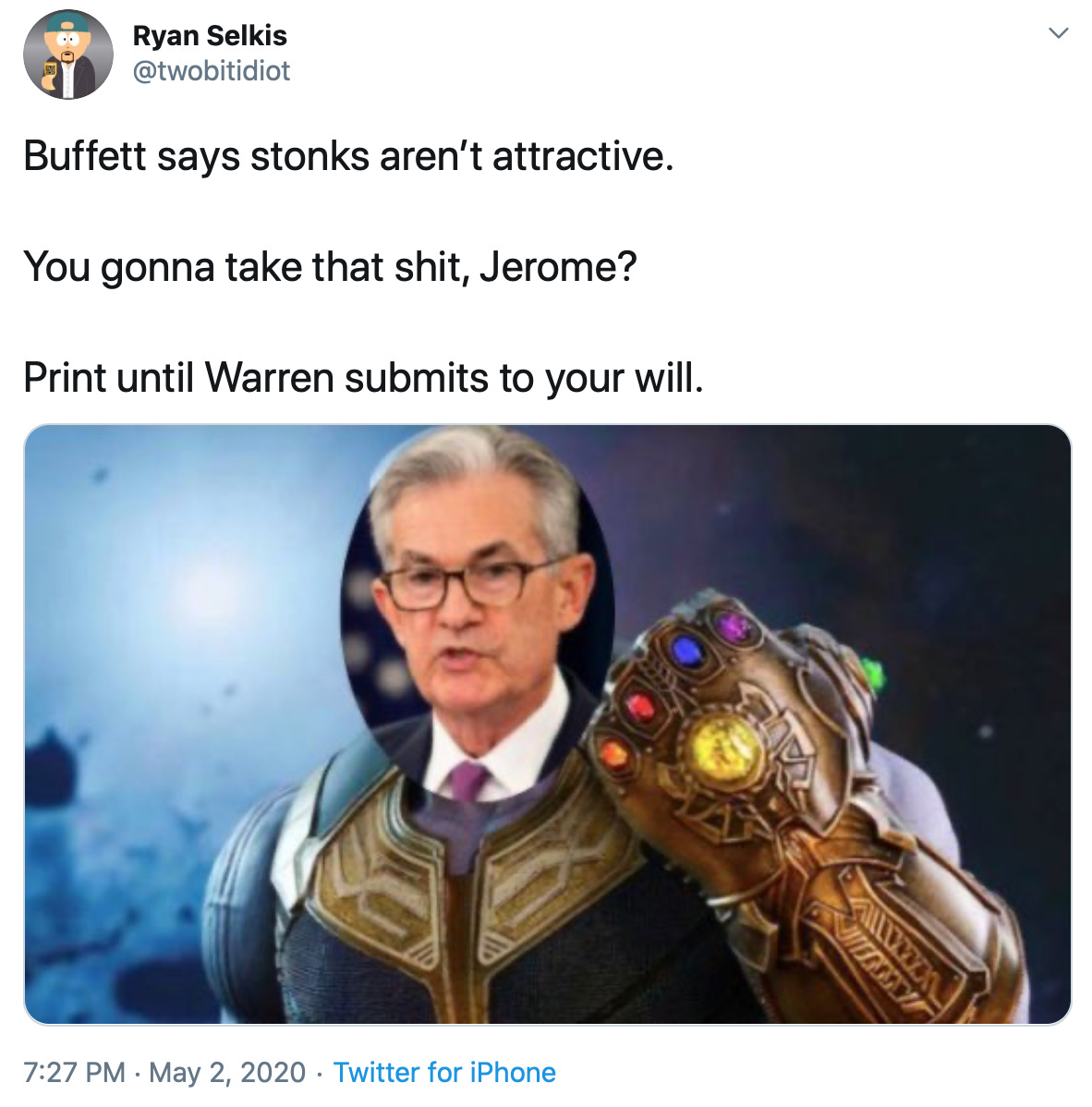

My favorite point that Warren Buffet makes is how he “doesn’t want to be dependent on friends” referring to corporations asking their friends in Washington for a bailout instead being fiscally responsible and keeping cash on hand. But it is important to note that Warren Buffet isn’t only not deploying any of his cash right now, he’s adding to it. He even went on to say, “We haven’t done anything because we don’t see anything that attractive to do” specifically answering a question regarding why he hasn’t deployed any cash yet.

Airline stocks have taken a substantial beating since air travel has come to a screeching halt. Warren Buffet informed shareholders during the meeting he had dumped all of his airline stocks saying, “I was wrong about that business”. He determined he had "made a mistake" regarding the maturity of the airline industry and its future. Throughout the first quarter Warren Buffet was selling significantly more than he was buying.

Warren Buffet isn’t the only one holding cash either.

[Billionaire Investor] Carl Icahn isn’t buying stocks right now. He’s hoarding cash, shorting commercial real estate and preparing for the coronavirus to wreak more havoc. - Bloomberg

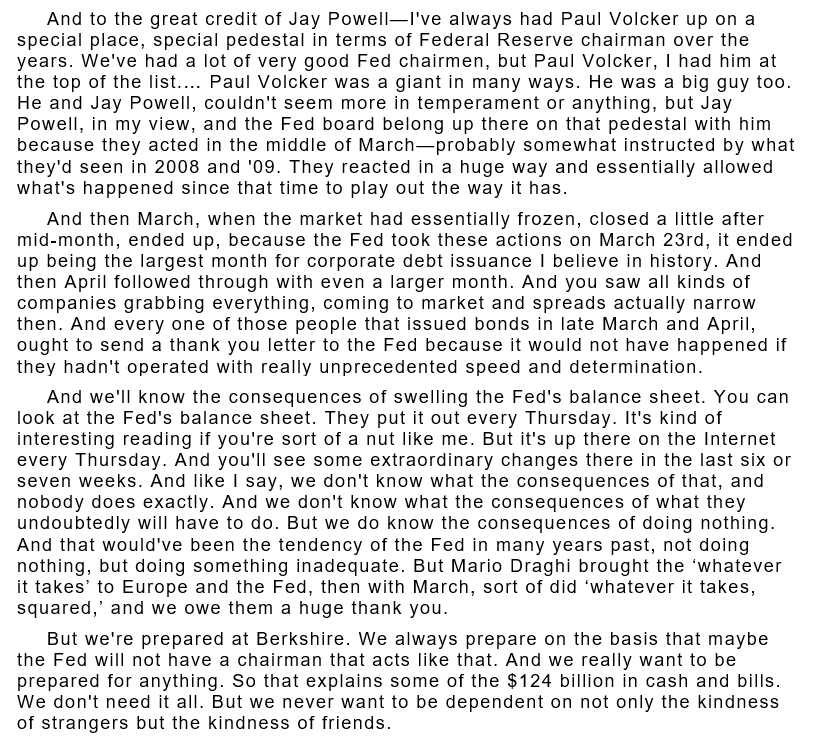

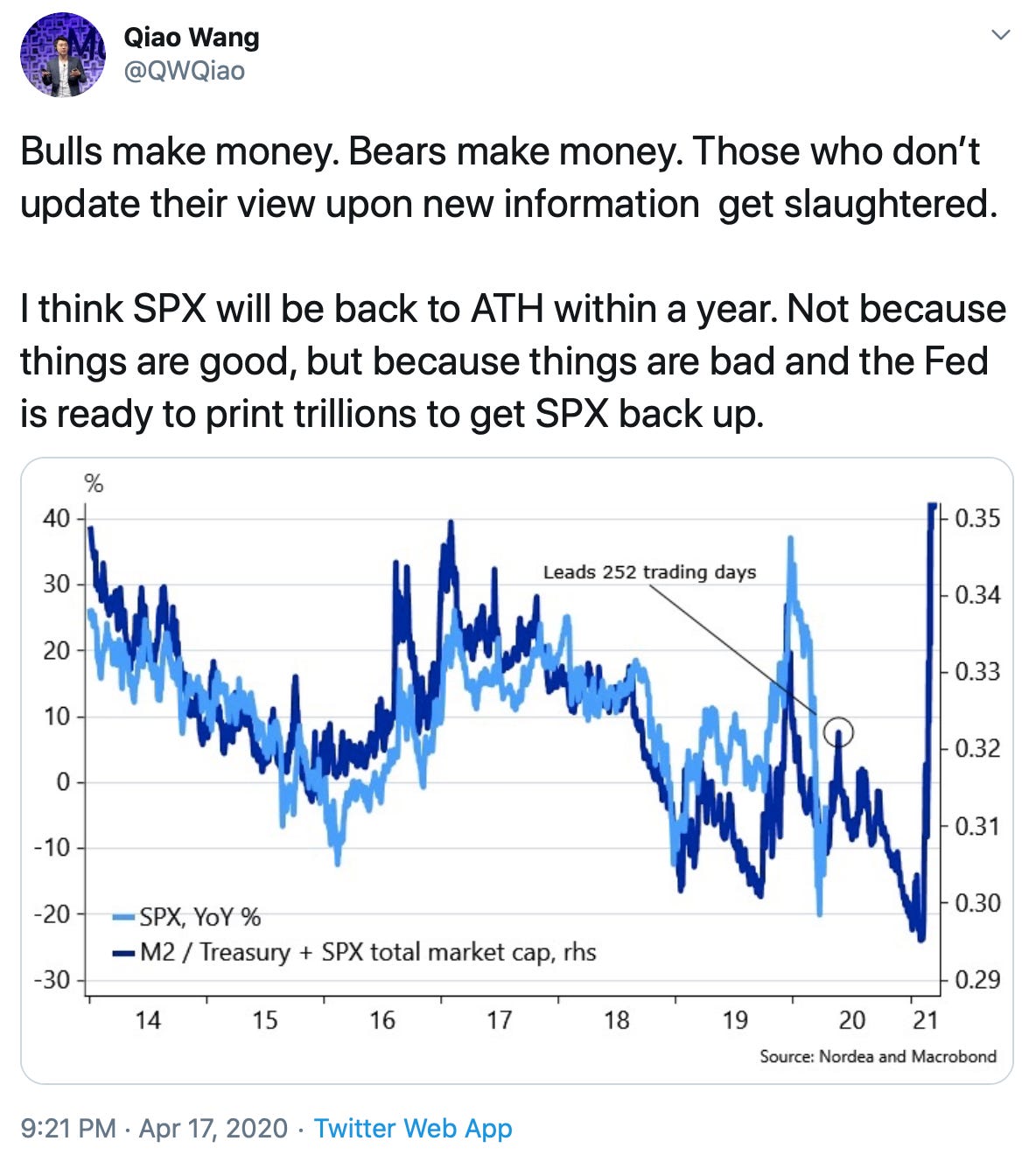

However, there are others who are a bit more optimistic (in the short term at least) of the stock market due to the Fed’s intervention.

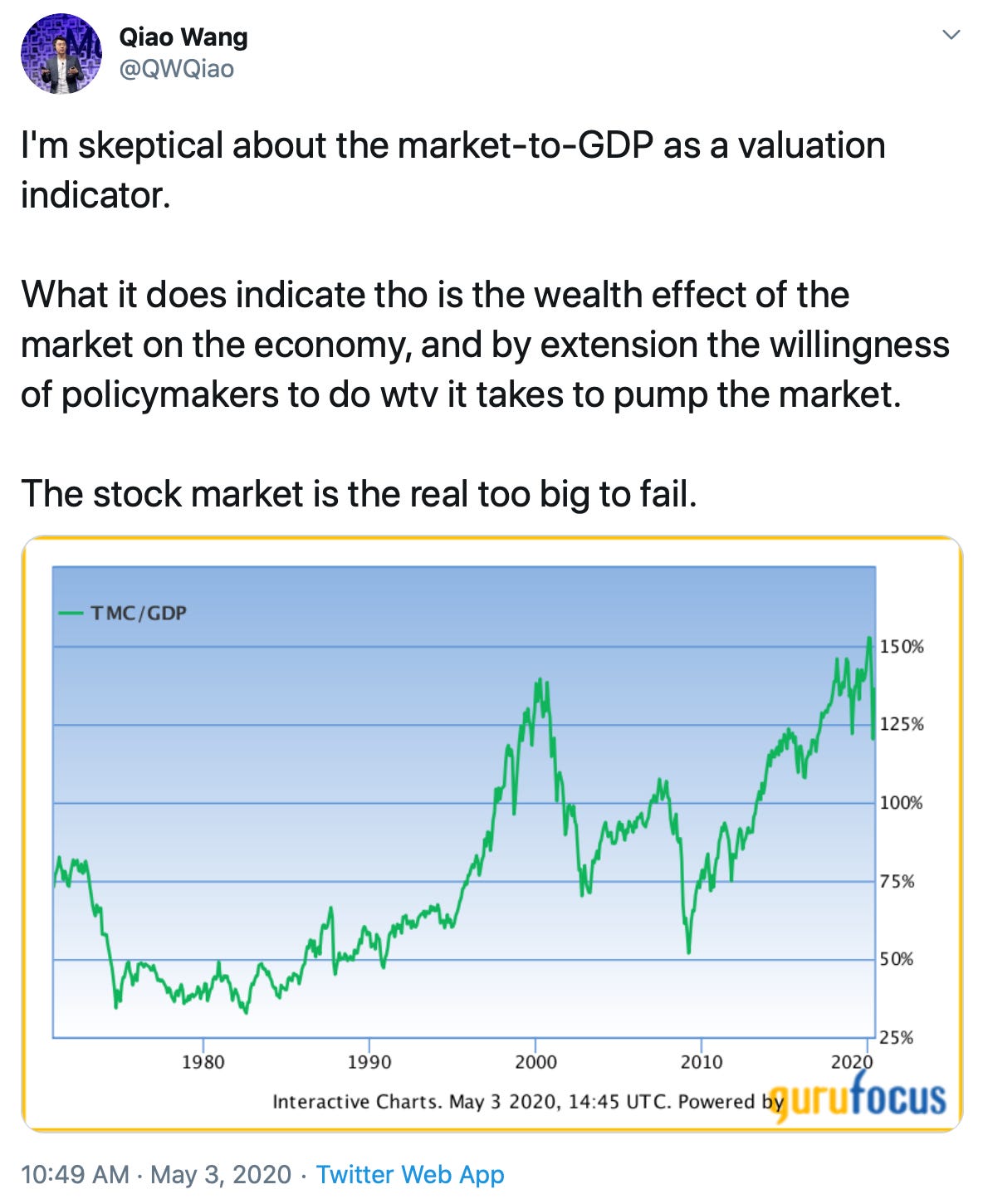

And he’s right, the stock market is too big to fail. There are too many jobs at stake to for the Fed to do nothing. Qiao Wang claims we could see all time highs in the stock market again within the year because of the Fed’s actions — but once again not without long term consequences.

If the stock market is too big to fail then our government and the Federal Reserve won’t let it or at least they will try. Our economy is retracting but, thanks to the Fed, it’s possible stocks will continue to rise.

Qiao Wang made an incredibly forward-looking Tweet on December 26th which shows how most people in the finance/tech community were preparing for coronavirus far before our government decided to start taking action.

The whole thread is a great read but the last tweet of the thread is the most important.

Inflation is real. The problem with gold is that if you wait until when you need it to buy it, it’s usually a sellers market, in short supply or both. Thats why you want to buy gold before you need it. The same logic applies to bitcoin for some of the same reasons but also for several others including its monetary policy.

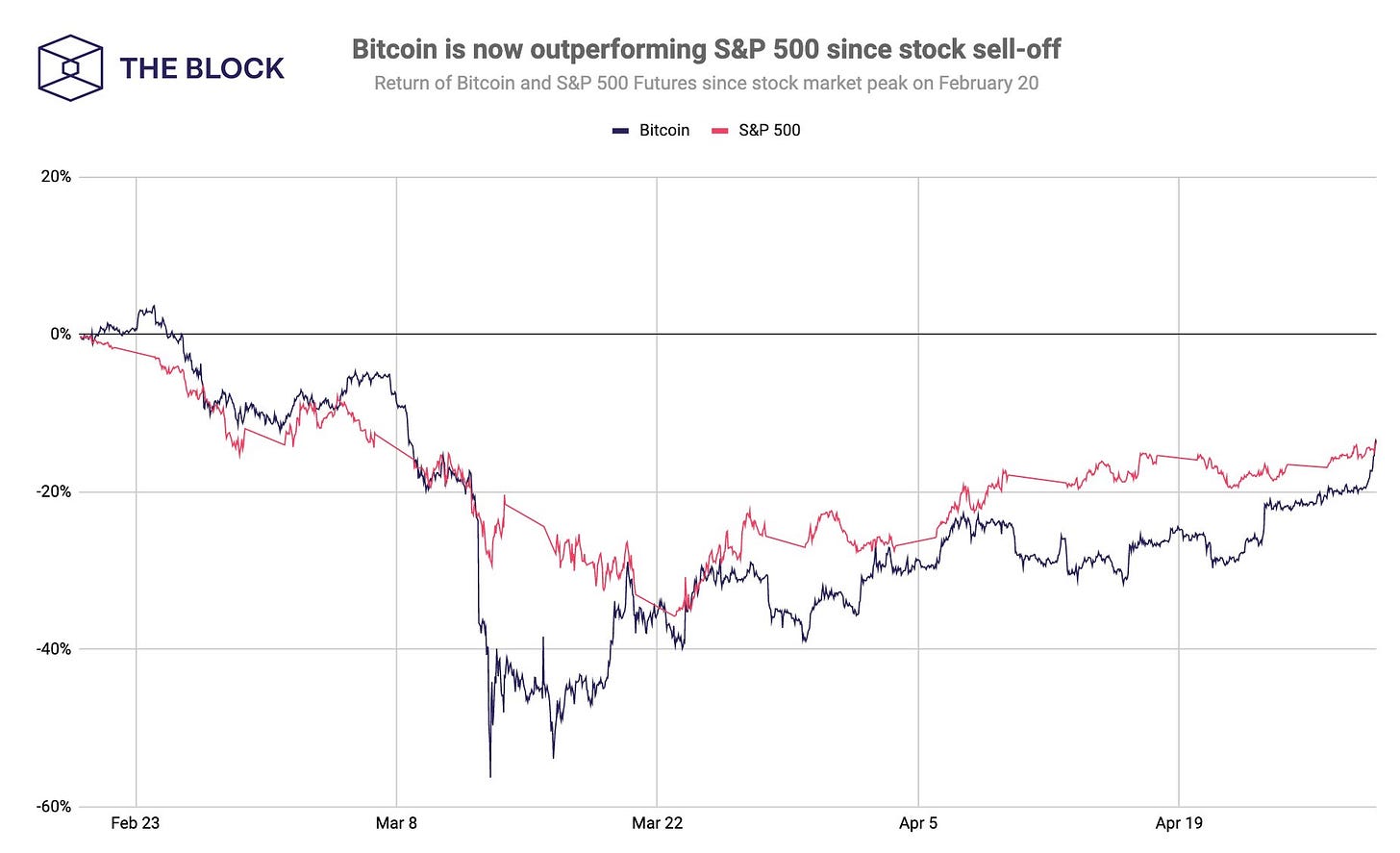

In my previous newsletter I spoke about how the price of Bitcoin is not correlated with any other asset class. But that was not the case following the recent market sell-off. Due to investors “buying cash” bitcoin’s price has been highly correlated with the S&P 500. However, towards the end of April, Bitcoin and the S&P 500 began to decouple.

The market sell-off began on February 19th and on April 29th Bitcoin began to outperform the S&P 500.

The S&P 500 is now lagging Bitcoin. In fact, Bitcoin is just about back to its original price before the sell-off.

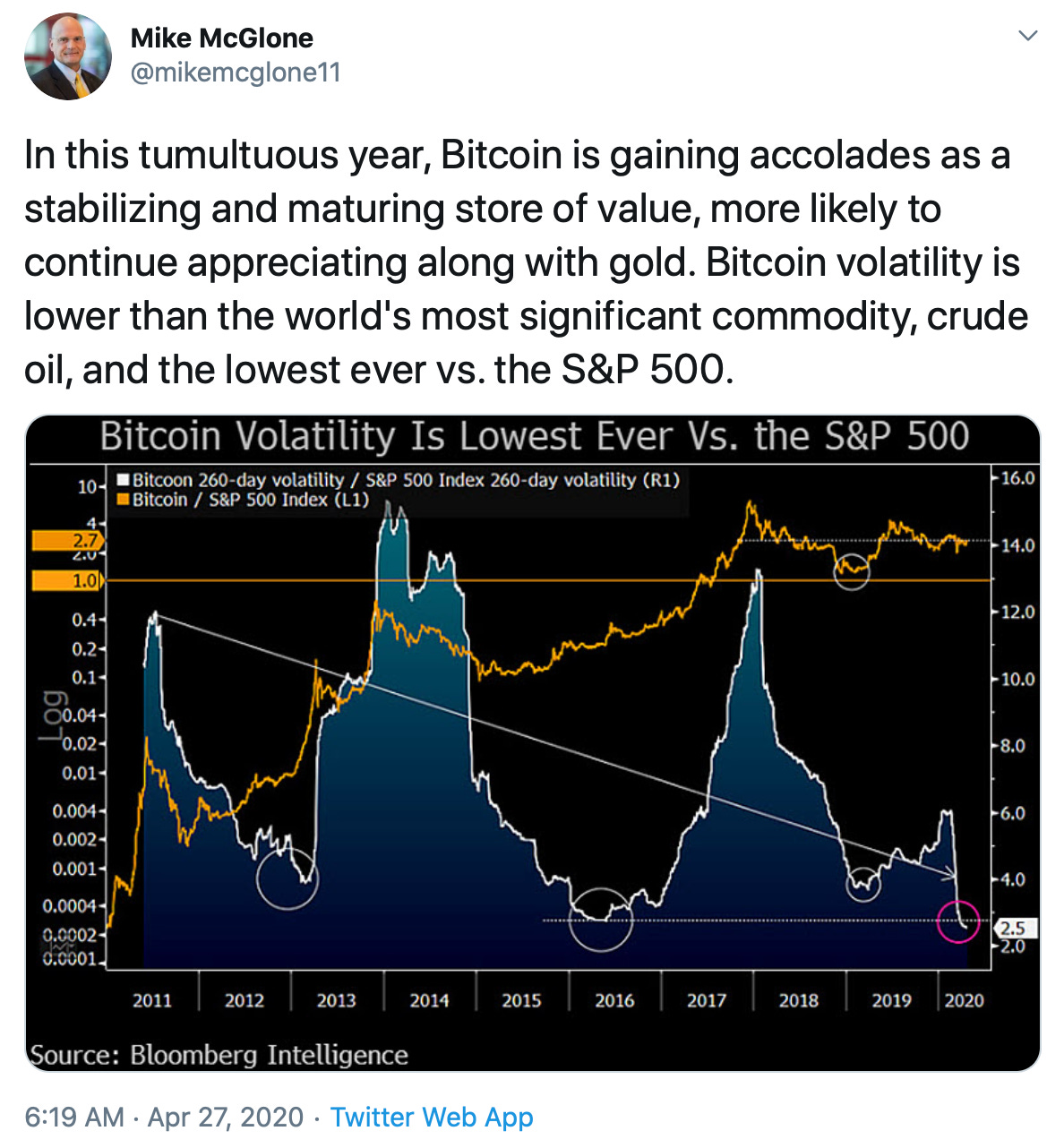

And even more interestingly, Bitcoin’s volatility vs. the S&P 500 has reached an all time low.

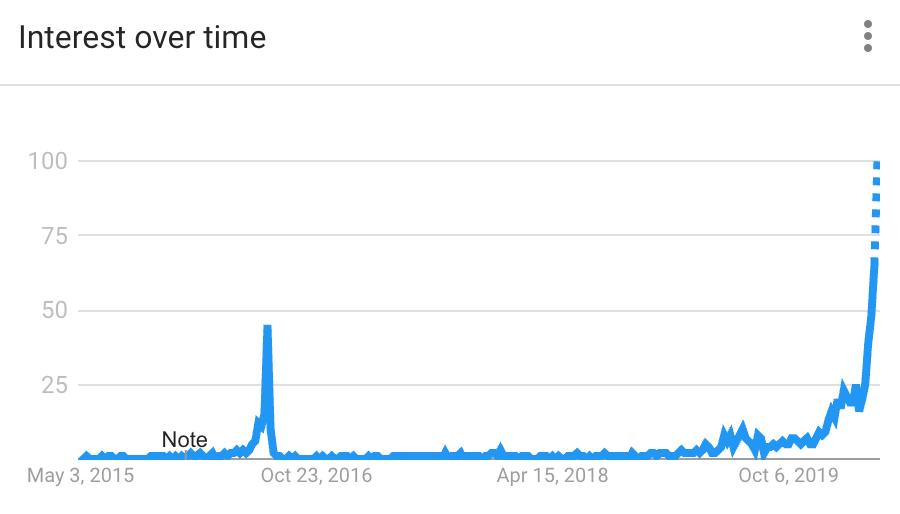

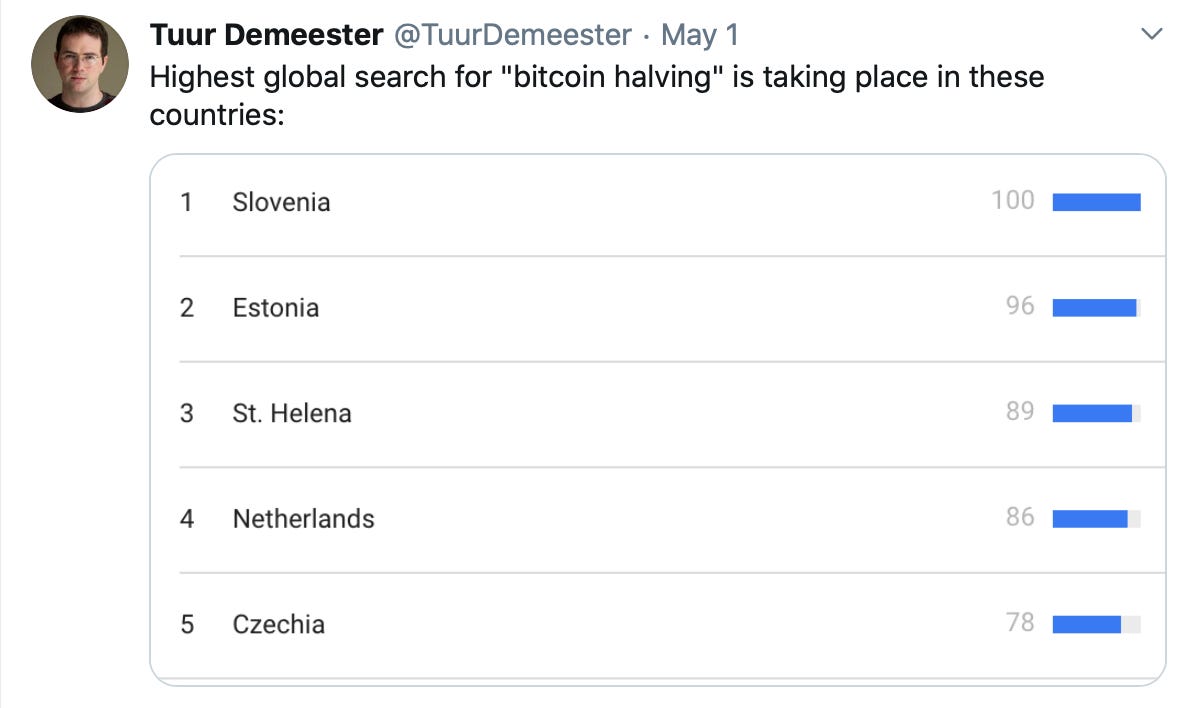

Global searches for “Bitcoin Halving” on google have been skyrocketing

Bitcoin’s ability to cross borders is something we’ve never seen with a non sovereign currency before other than gold. This really goes to show how universal bitcoin is and how it’s truly a global currency.

But to understand where Bitcoin is headed you must first understand its origin. Take the time to read the following: The Annals of Bitcoin Twitter

Conclusion: Bitcoin has made an incredible recovery. Now the world is watching to see what happens next. It’s possible, and in my opinion, very likely that the S&P 500 will retest its lows. With the Bitcoin Halving coming up, I think it’s important to have exposure while also keeping cash on hand for the possibility of lower stock prices.

Disclaimer: I am not a financial advisor. I created this content for research and educational purposes only. If you’re interested in investing in Bitcoin I suggest doing your own research.

If you have any questions, comments, or suggestions please feel free to reach out to: MarketAlphaTeam@gmail.com