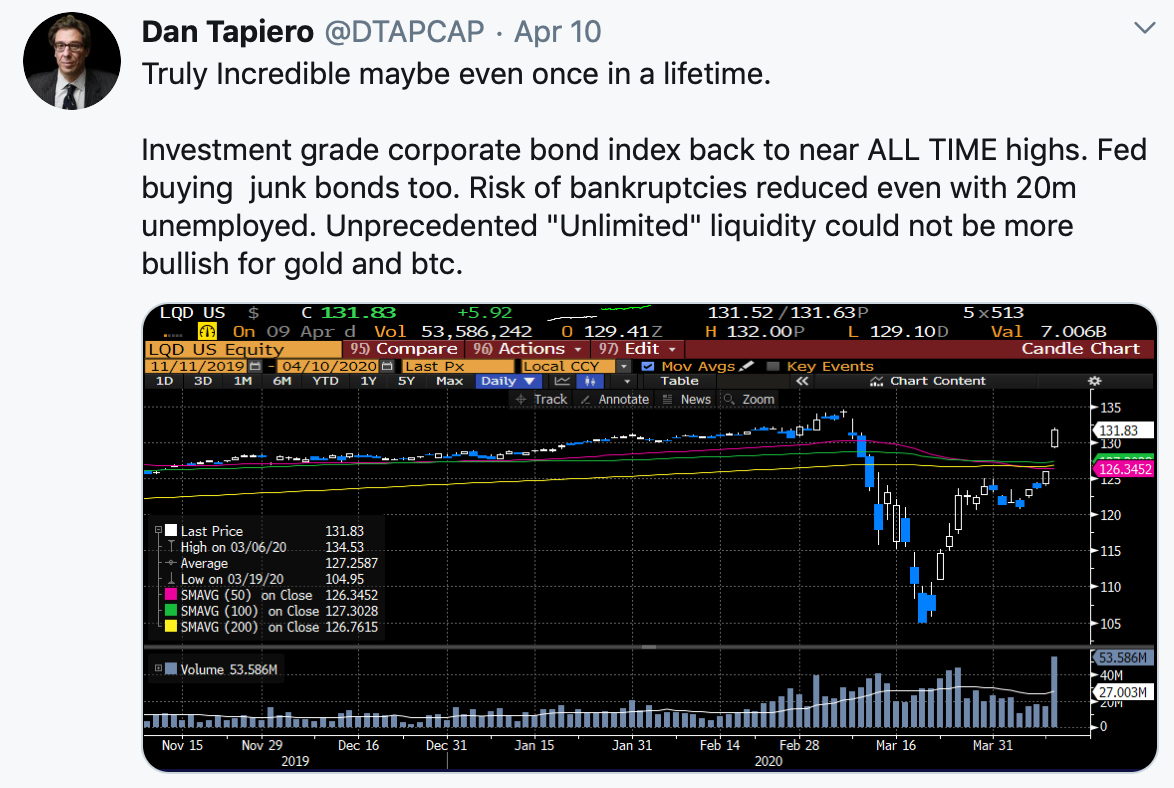

This week’s report from the Labor Department added 6.8 million jobless claims bringing the total to roughly 17 million claims. At the same time, the Federal Reserve announced an additional $2.3 trillion in new stimulus to expand aid to small and medium businesses.

Chairman Jerome Powell has made it clear that he is willing to take any action necessary to protect the economy from collapse.

The money comes on top of the massive stimulus that the Fed had already announced and it thrusts the institution into the sort of speculative lending activities it had shunned in the past -- underscoring the risks that Chairman Jerome Powell is willing to take to shore up the economy. - Bloomberg

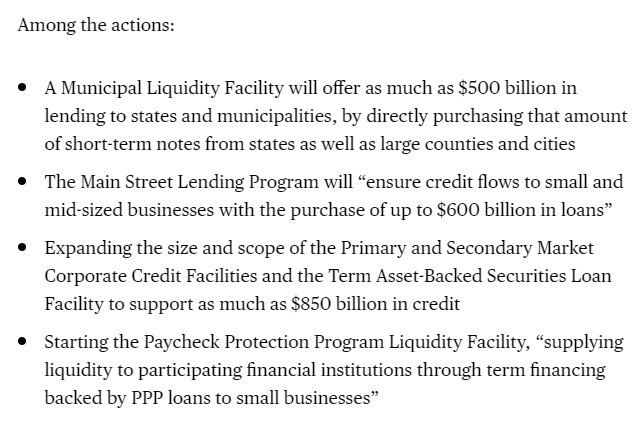

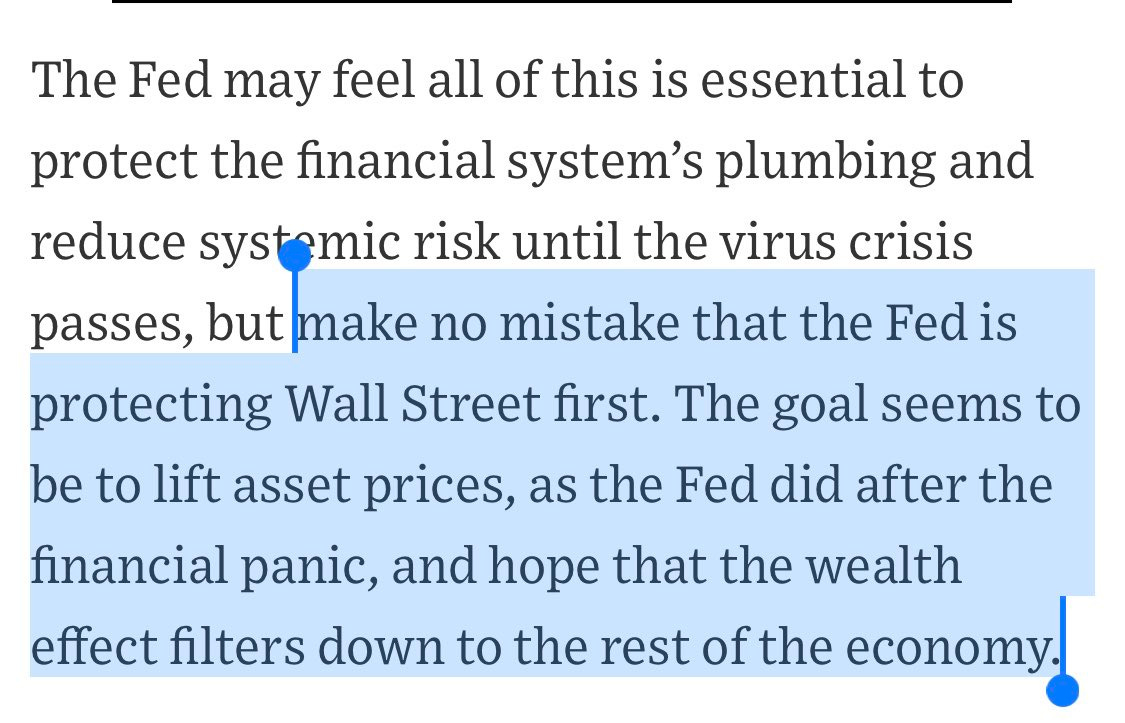

The Federal Reserve primarily targeted Wall Street with their previous stimulus packages leaving Main Street out to dry. Liquidity was being provided to large hedge funds and banks while the majority of small and medium businesses couldn't get the required funding to stay afloat. Here is an excerpt from the Wall Street Journal supporting Sven Henrich’s description of the Federal Reserve’s original plan to save the the top 1% and hope for trickle down economics later:

Sven Henrich put it very succinctly:

Where are the bailouts for the working class? Do they think $1200 supplements two months of lost wages? They quickly realized that their initial relief to small and medium businesses wasn’t enough. Will they do the same for working class individuals or will they continue to hope for trickle down economics?

In my opinion, if you are waiting for the government to save you, you will be waiting for a very long time — possibly forever.

While the Fed panic buys everyones debt, student loan payments have been suspended for 6 months, New York has begun burying bodies outside of New York City, and unemployment numbers continue to rise as companies like Disney furlough 43,000 employees.

By no means is this the end of the world but I do think the average person’s newly found optimism is a bit premature. A lot of investors, especially among retail are expecting this rally to continue but there isn’t much evidence to support this.

When the economy is shut off it doesn’t exactly turn back on by the flip of a switch:

But why are swift economic recoveries so rare?

However, the government inflating asset prices by providing “unlimited” liquidity while our economic situation worsens presents an opportunity. You cannot solve an economic crisis by creating a monetary crisis. And that is exactly what the Federal Reserve is doing.

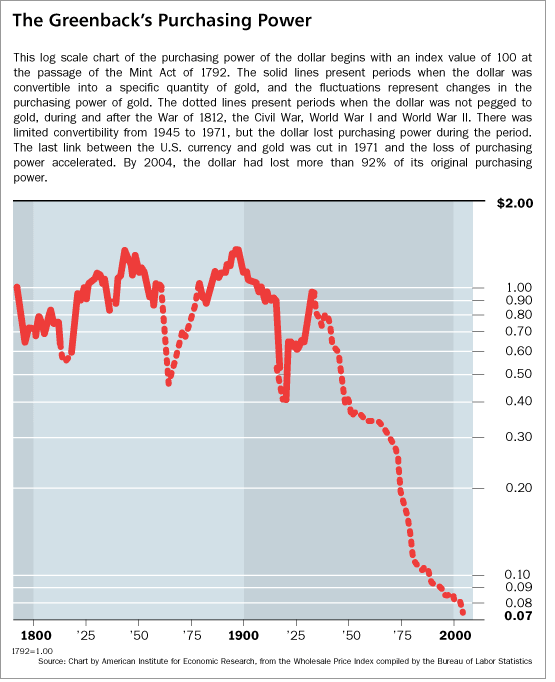

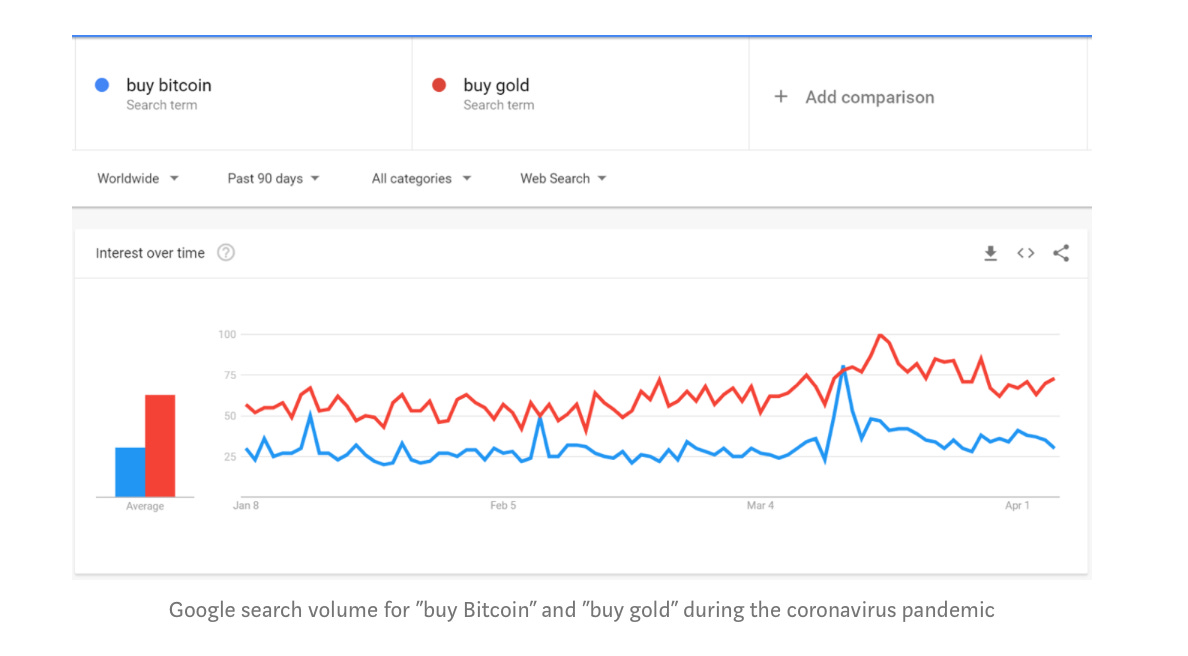

In a world of “unlimited” fiat money there aren’t many truly scarce assets. Throughout history investors have flocked to gold in times of crisis and I don’t expect that to change anytime soon. Gold’s money-like properties and high stock to flow ratio are what gives the precious metal its store of value status. As governments around the world began printing unlimited amounts of fiat money investors looked for a way to protect their purchasing power. Gold became a risk off asset as well as a hedge against inflation.

A simple rule of thumb is if the interest rate on your savings account is lower than the rate of inflation than your money that’s sitting in the bank is gradually losing value. The supply of money directly effects the price. Central banks perpetually increase the supply of money which causes their to dollar continue to lose value and consumers continue to lose purchasing power.

In times of uncertainty and unprecedented central bank intervention I am a buyer of gold. And I'm not the only one.

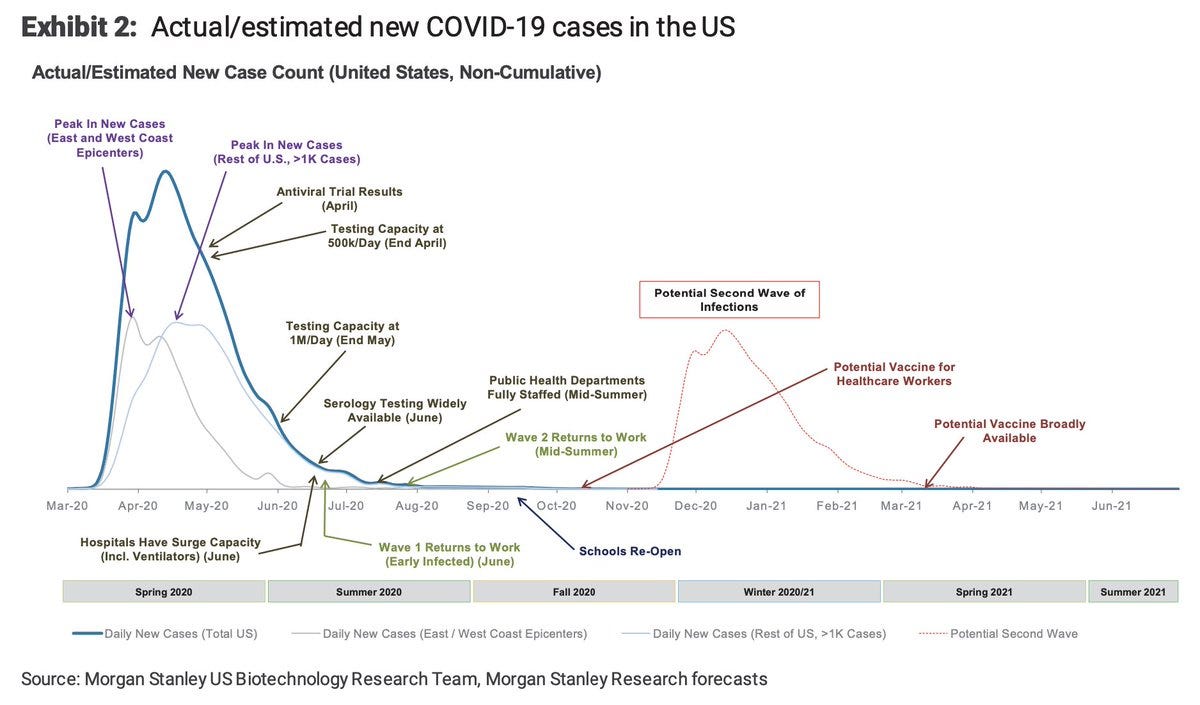

The situation regarding the coronavirus is only becoming more uncertain as governments around the world struggle to prevent the spread of coronavirus while also keeping supply chains intact. Morgan Stanley’s forecast for new coronavirus cases also shows the possibility of a “second wave” which shouldn’t go unheeded. And of course to add insult to injury, the Federal Reserve has been adding trillions of dollars to the budget every week primarily targeting big business while giving workers and small & medium businesses the brunt of it. This is a recipe for disaster.

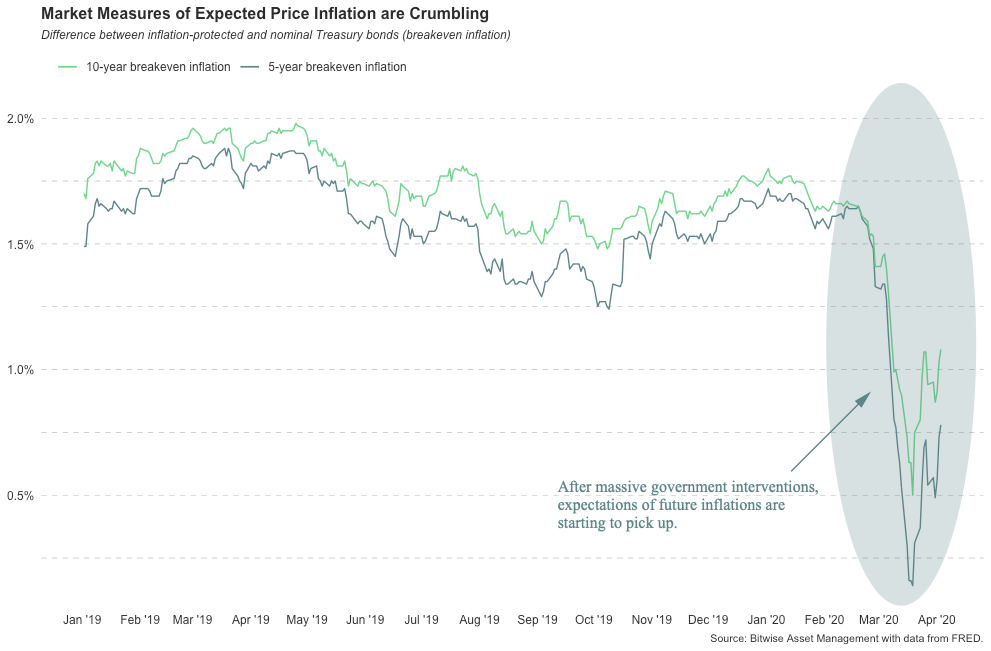

The initial shock of the economic shutdown has been deflation due to the lack of consumer demand causing future expected inflation to plummet. However, as soon as governments around the world began to announce massive fiscal and monetary responses to the coronavirus future expected inflation began a rapid ascent.

As governments seek to fill the economic hole left by the pandemic, there is a significant risk that they will overshoot, not just averting deflation but jumpstarting significant inflation. - Matt Hougan Bitwise Asset Management

In the 2008 financial crisis, Gold was initially hit by the same deflationary effect as seen today. This led to a preliminary drop in price followed by a massive rally over the past decade as the government began QE to respond to the crisis.

It took a lot longer for the government to respond to the 2008 financial crisis than it did for them to respond to the coronavirus. This is why the Dow Jones just its best week since the Great Depression even though economic data, like unemployment numbers, continue to paint a bleak picture. This gave us the most ridiculous moment in CNBC history:

For the first time in history our government agreed on something — if we are going to shutdown the economy then the government needs to supplement both businesses’ revenues and and employee’s incomes. However, to assume this wouldn’t have future repercussions is naive in my opinion.

The narrative quickly switched from “will I have enough money?” to “will my money be worth anything?” The Founder of Barstool, Dave Portnoy, made a reference to the popular TV show The Office this week saying, “It’s like Schrute bucks, if every government could just print unlimited Schrute bucks, why wouldn’t they?” Countries like Venezuela and Zimbabwe are perfect examples of what happens when a government prints too much money. Bitcoin is actually so popular in Venezuela that its always trading at a premium since the native Bolivar has been hyper-inflated by the government.

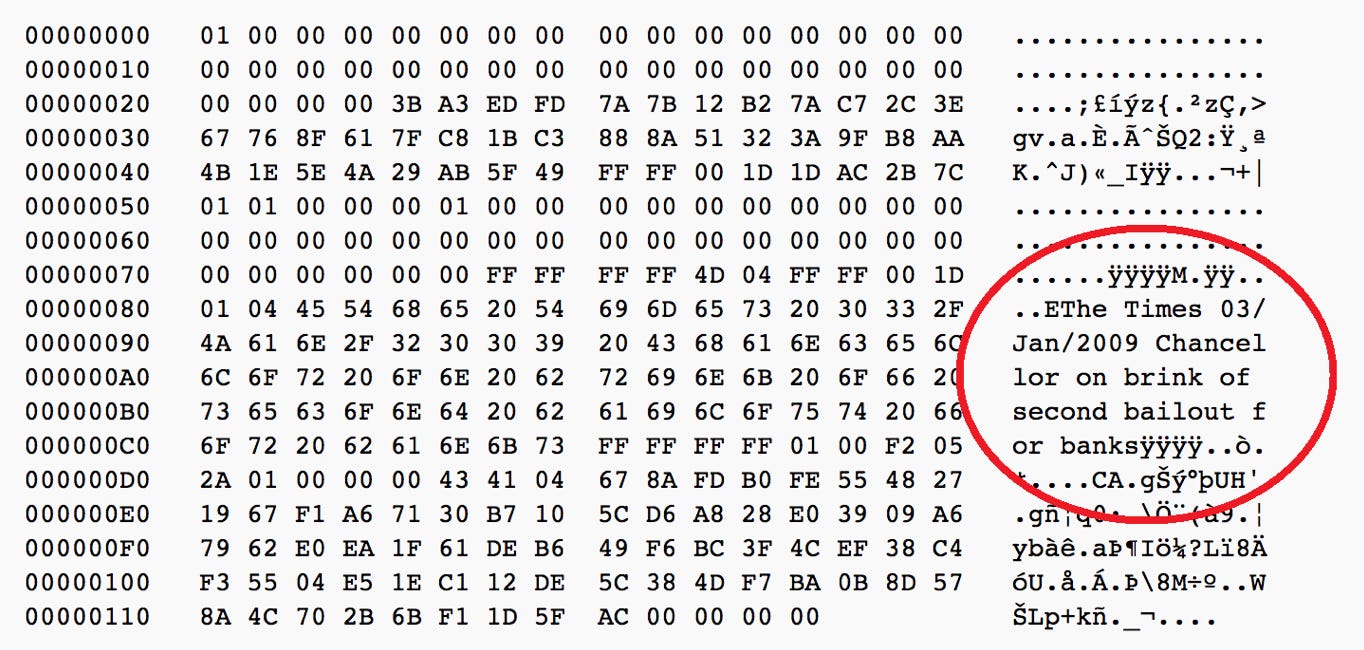

No asset has achieved what gold has over its lifetime which is why its used as a battle-hardened store of value. But the world continues to progress and new technologies arise as do new crises. Bitcoin was created in the midst of the 2008 financial crisis. For decades cryptographers, economists, and libertarians have been trying to make a ‘digital gold’. But it wasn’t until the 2008 financial crisis that it finally came to fruition. An anonymous cypherpunk that went by the pseudonym Satoshi Nakamoto created the Bitcoin Whitepaper where s/he lays out the framework for the peer to peer currency.

The Genesis block (The first set of transactions verified by the Bitcoin blockchain) reads “chancellor on the brink of second bailout” which is the headline from the New York Times article signaling the Federal Reserve’s bailout package for the banks.

The idea behind the creation of bitcoin is that you don’t need a third party verification system to send value to another person. For example, If you want to send value (money) to someone else you need a bank, PayPal, Venmo, or some other sort of third party to verify the transaction. To over-simplify, Satoshi solved the double spend problem by implementing the blockchain which decentralizes power among miners and users. This allows no single entity to control the network or control the flow of transactions. In other words, nobody can censor your transactions. To get a better understanding of how the bitcoin blockchain verifies transactions I suggest diving deeper.

Bitcoin is a non-sovereign currency driven by free market principles, not by a central authority like the Federal Reserve. To get a better understanding of how Bitcoin’s ecosystem works and the evolution of bitcoin mining I suggest diving deeper.

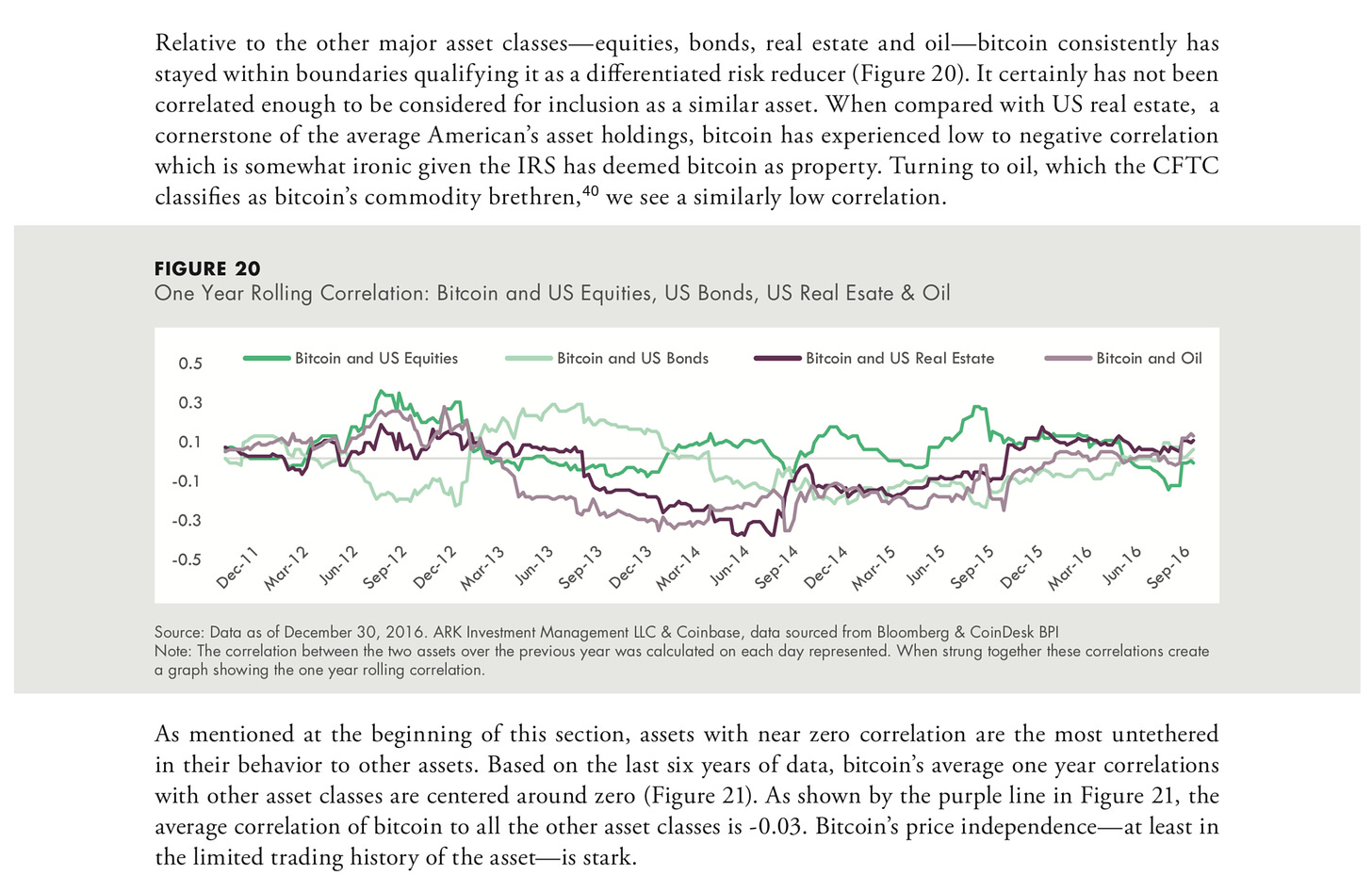

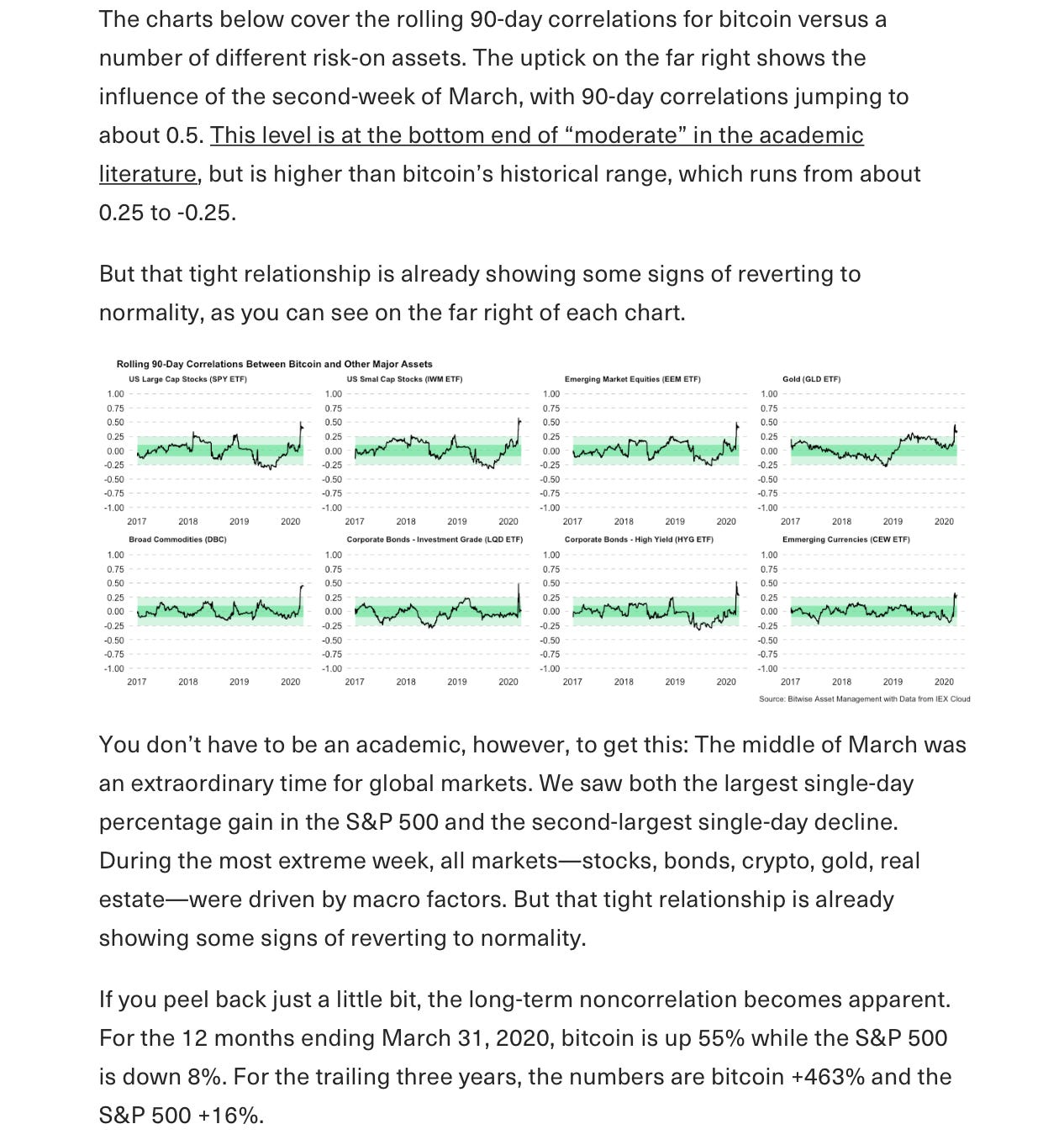

Bitcoin has a very unique investment profile. Bitcoin is an uncorrelated asset. It is very rare to achieve non-correlation status with even one asset class let alone all of them.

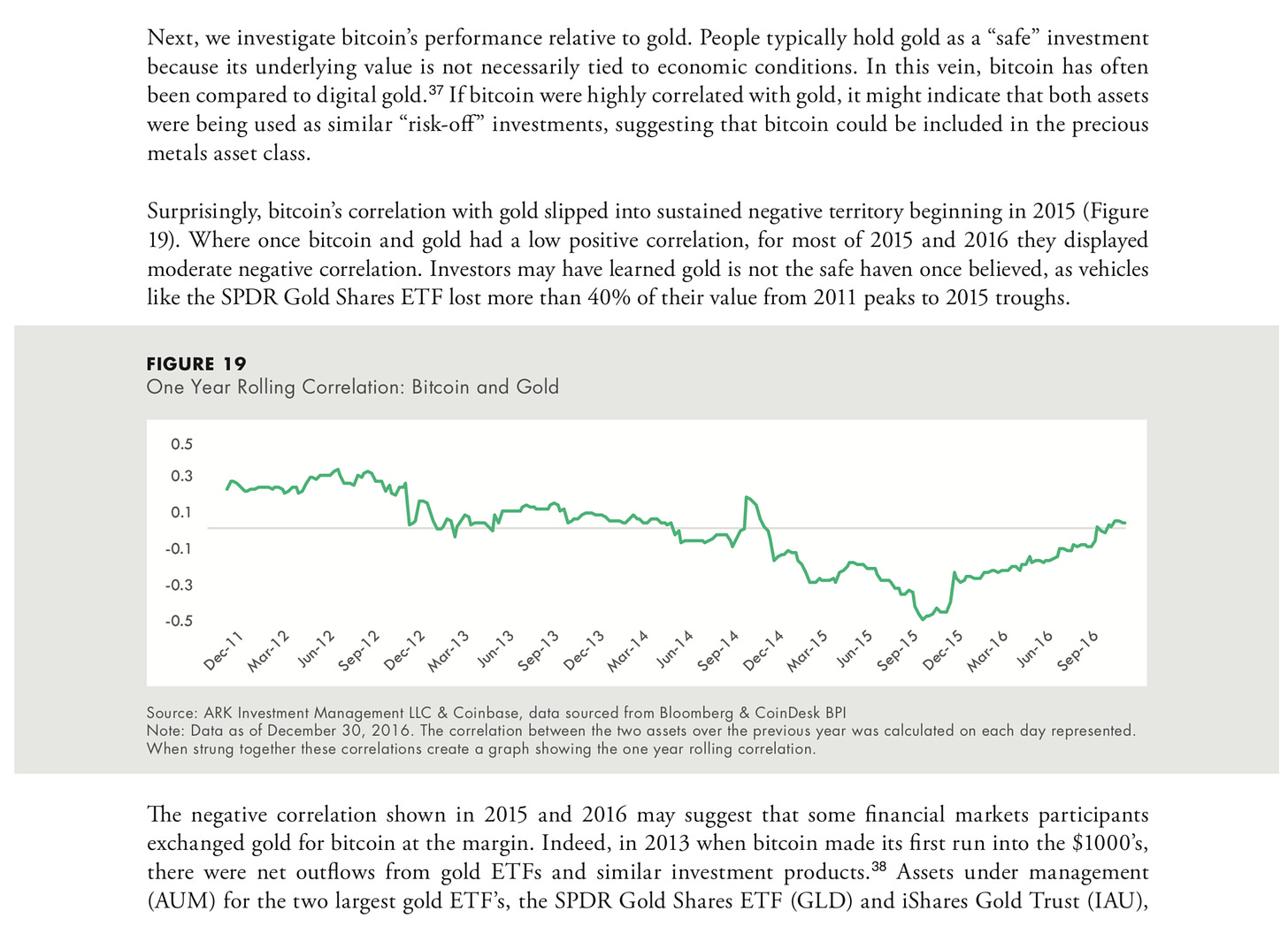

Interestingly enough Bitcoin isn’t even correlated with gold. Ark Invest uses this data to make the case for why Bitcoin has created its own, new asset class.

However, during the market sell off both Bitcoin and Gold became highly correlated with the stock market. When the coronavirus news broke and the stock market crashed harder and faster than ever, so did both bitcoin and gold. This was expected as every asset went through the same deflationary shock. Risk off assets were turned into risk on assets as investors sold everything, including the kitchen sink, to get cash heavy. In fact, I like to say that investors were “buying cash” opposed to selling their assets.

This is common during market turmoil as investors need cash on hand to scoop up undervalued assets. The more cash on hand the more cheap assets an investor can purchase. This is why, in my previous newsletter, I said I am patiently waiting for Warren Buffet to start deploying some of his $120 billion stockpile. He will but only when the time is right and that’s usually when companies start offering him incredibly favorable stock options.

Almost every asset class become correlated during the market sell off. But both Bitcoin and Gold have each begun to decouple from the broader market.

The recent market sell off was the ultimate stress test for Bitcoin. Financial commentators have tried to make the argument that since both gold and bitcoin sold off in a risk environment that they can no longer be a valid store of value. We know from the 2008 crisis that gold is not immune to deflationary shock, and we now know bitcoin isn’t either. Gold has also proven its longevity but I believe bitcoin will soon prove its resilience.

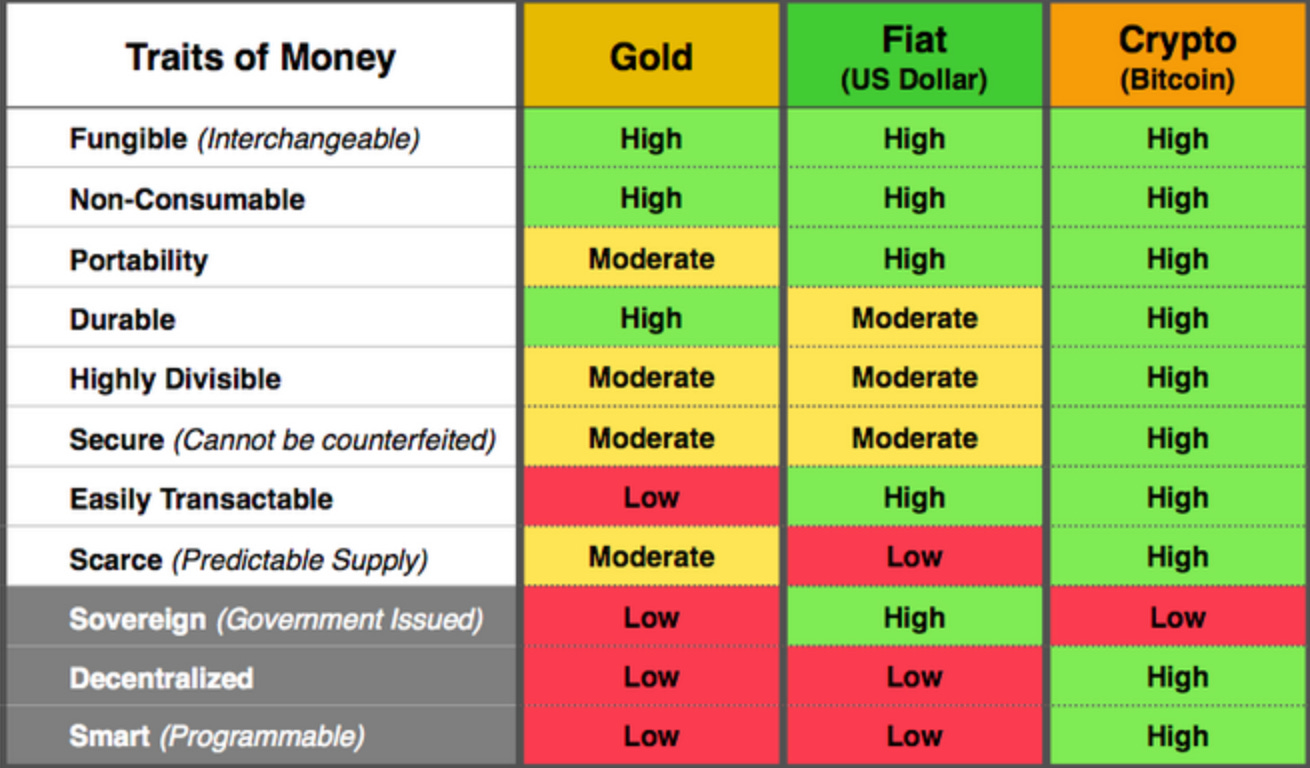

Bitcoin’s true value proposition outside of money is as an inflationary hedge. But why not just buy gold, the original hedge against inflation? The first stems from Bitcoin’s properties as money. Bitcoin meets all the criteria of money better than both gold and fiat giving it a unique edge in the digital era. In my opinion, Gold’s most attractive feature history as a financial instrument. We know that throughout history all fiat currencies have failed simply because all past governments have failed. Gold may have gone through periods of low to no usage but it’s always been revived.

I personally find Bitcoin to be a more attractive investment than gold but I do suggest having some exposure to gold (physical gold, gold mining stocks, ETFs) as a diversifier and as a way to hedge against uncertainty.

To get a better understanding of Bitcoin’s properties I suggest taking a deeper dive.

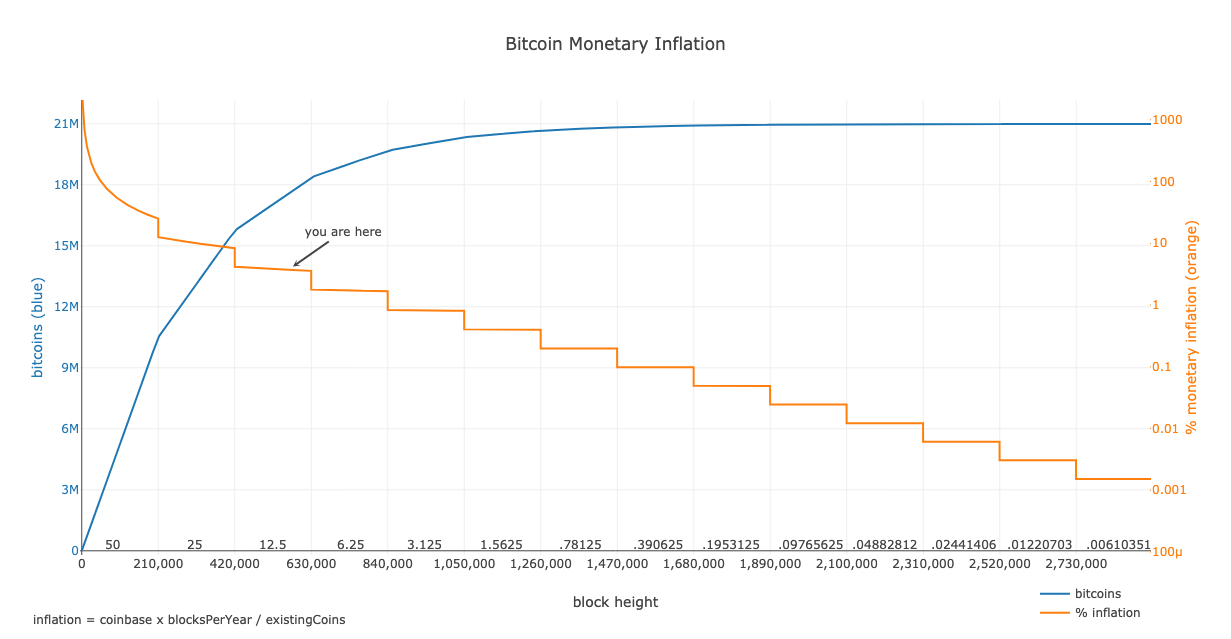

Bitcoin’s monetary policy is what makes it such a great hedge against inflation, especially in comparison to gold. Bitcoin is programmed to release more Bitcoin into circulation every time a new block is mined or about every 10 minutes until the hard cap of 21 million bitcoin is reached. Bitcoin is estimated to reach this hardcap by around 2140. Until then bitcoin will become increasingly scarce as the amount of bitcoin that gets put into circulation halves every 4 years. Bitcoin miners are currently running smoothly (at least the ones that are still profitable) while gold miners have been forced to comply with the economic shutdowns across the globe affecting supply.

Bitcoin is a disinflationary currency which means the amount of bitcoin that gets put into circulation every 4 years decreases. This is what separates bitcoin from inflationary fiat money. In may, the amount of bitcoin that is added to the circulating supply will be cut from 12.5 to 6.25 bitcoin. The Bitcoin stock to flow model attempts to map out price in relation to supply following this 4 year halving cycle. Remember all models are wrong but some are useful:

If price were to continue to follow this stock to flow model then price would oscillate around $100,000 by 2022. The stock to flow model may be disproven in the future but its correlation over the past decade is something I find particularly interesting.

Conclusion: Bitcoin doesn’t care about the pandemic and it doesn’t care about if people see it as a store of value or not. As Nic Carter said, "I think the pandemic will have little direct impact on Bitcoin. However, the extreme measures governments are taking in response to the crisis are material to Bitcoin.” Bitcoin has already begun to climb back to its price before the crash. The reason I suggest both bitcoin and gold as opposed to just bitcoin is because gold has a proven track record during market turmoil while bitcoin has yet to prove itself during a financial crisis. There are economic consequences to what the Fed is doing and having exposure to both will help you weather this crisis while keeping you hedged for the future. Even if you aren’t as convicted as I am when it comes to future expected inflation I still believe adding bitcoin (and gold) to your portfolio will at least reduce overall portfolio risk while increasing your risk to reward ratio.

There is a lot to unpack in this newsletter. The Bitcoin rabbit hole is deep and if you stumble in its almost impossible to find your way out. I will be going more in depth on topics related to Bitcoin and cryptocurrency in the future. If you have any questions, comments, or concerns please don’t hesitate to reach out. Some of my ideas in this newsletter are a bit progressive so if anyone would like to debate any of the points I am happy to do so.

Email: MarketAlphaTeam@gmail.com

Disclaimer: I am not a financial advisor. I created this content for research and educational purposes only. I suggest contacting your financial advisor to see whats right for you based on your personal risk profile.